what is a provisional tax code

Youll have to pay provisional tax if you had to pay. There are two compulsory provisional tax periods per year in which a provisional taxpayer will need to make payment.

United States What Tax Code Is Used For Tax Refunds Personal Finance Money Stack Exchange

Your provisional income is a combination.

. Find your tax code. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives. Provisional taxes are tax payments made throughout an income year.

You pay it in instalments during the year instead of a lump sum at the end of the year. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year. When you file your income tax return and calculate your tax for the year you deduct the provisional tax you paid earlier.

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the. This assists taxpayers in. If you earn non-salary income for example rental income.

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment. Provisional tax is a way of paying your income tax in instalments. What is provisional tax.

Natural person who derives income other than. Use our simple calculator to work out how big your tax refund will be when you submit your return to SARS. Its payable the following year after your tax return.

Estimated annual total income from all sources. What is provisional tax. Provisional tax helps you manage your income tax.

The calculation of provisional salaries tax is as follows. Salaries income for the previous year of assessment each deduction provisional tax for that year. Provisional tax is not a separate tax.

If your provisional tax paid is more than your RIT youll get a. B A provisional certificate of compliance is. A provisional taxpayer is defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No58 of 1962 as any.

Provisional income calculations can get a bit complex. Secondary tax rate before ACC levies 14000 or less. The level of income that is used to determine whether a taxpayer is liable for tax on his or her Social Security benefits and by how much.

Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. Secondary tax code for the second source of income. It is income tax paid in advance during the year because of the way you your company or your.

If you earn non-salary income for example rental income. Provisional tax helps you manage your income tax. The first provisional tax return.

All Income tax dates. Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Important Deadlines for Provisional Taxpayers.

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. Provisional tax is not a separate tax.

They go towards the tax payable on income with no tax credits attached. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return.

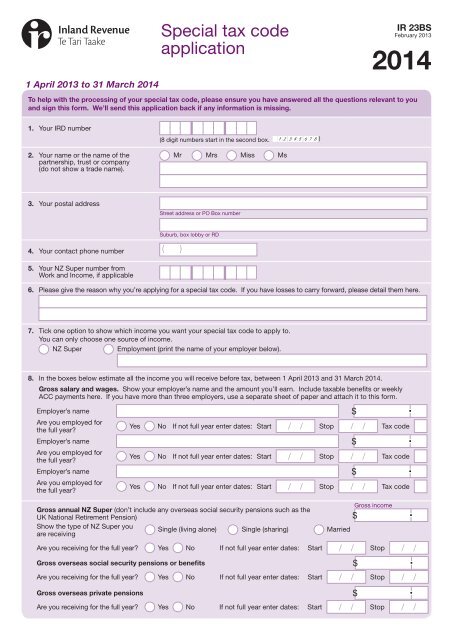

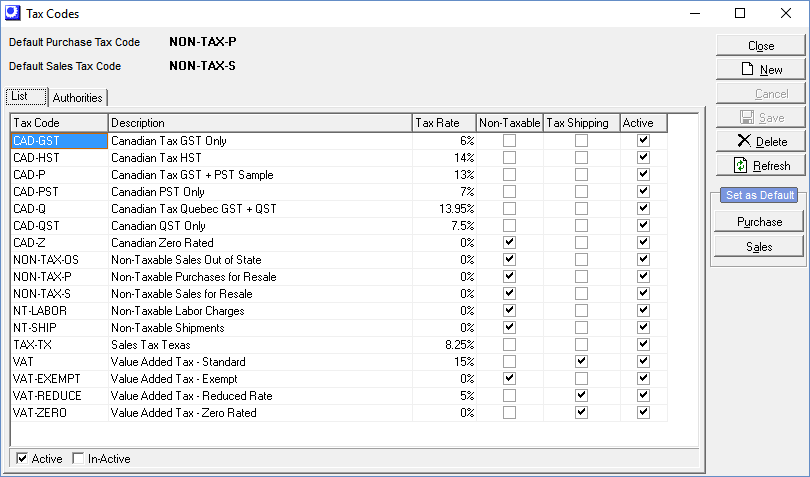

Special Tax Code Application Inland Revenue Department

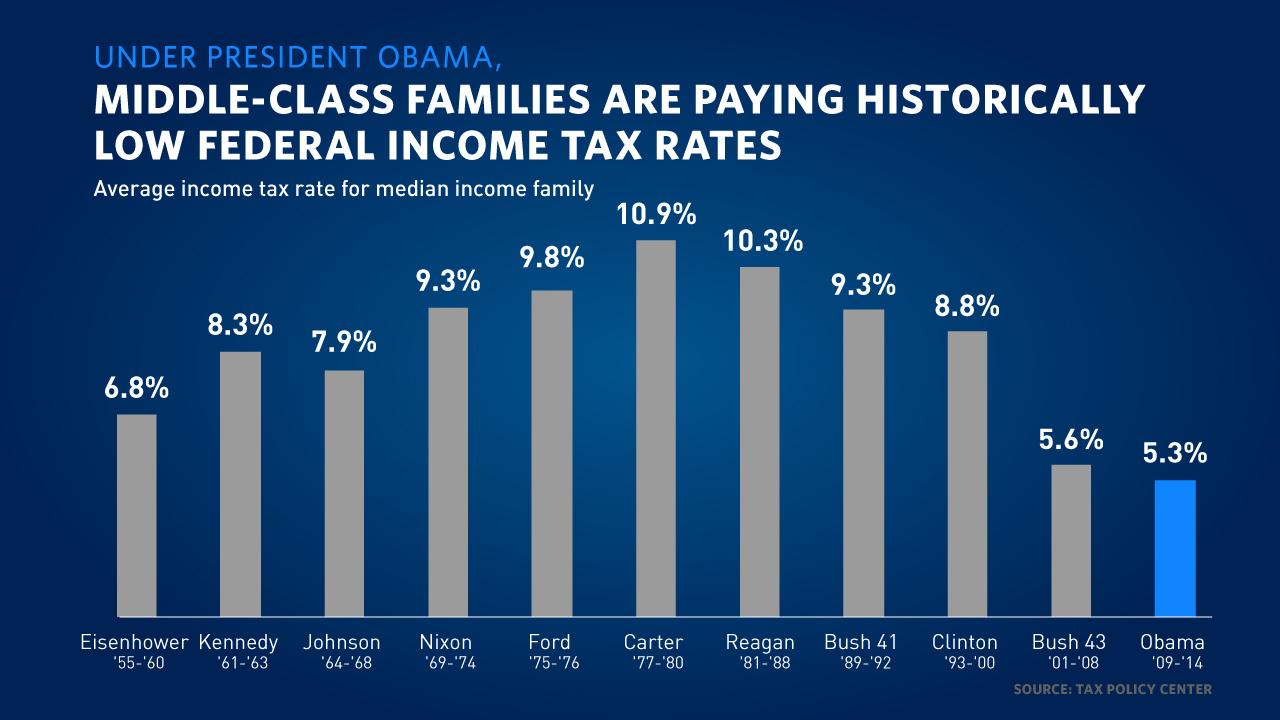

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

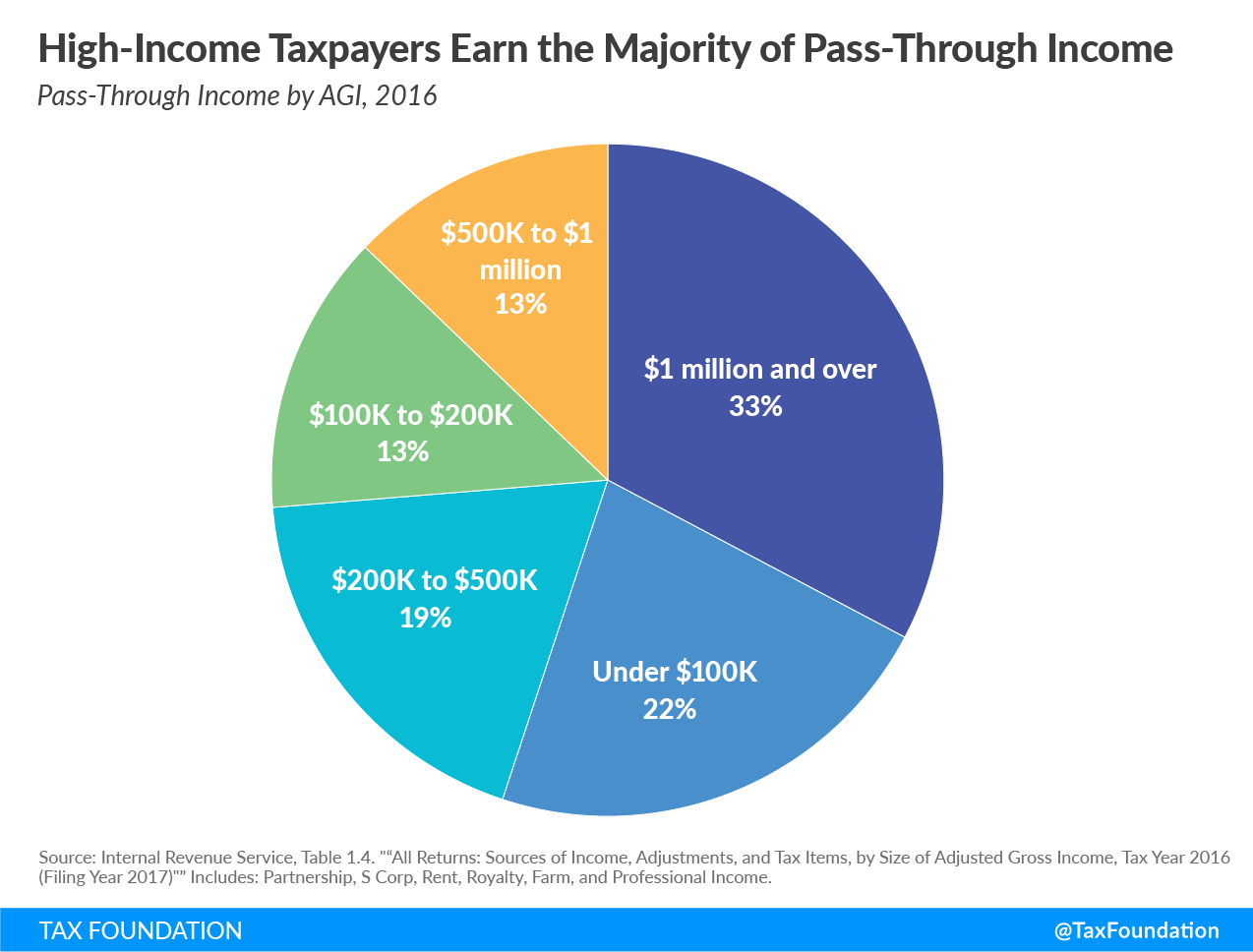

What Is A Pass Through Business How Is It Taxed Tax Foundation

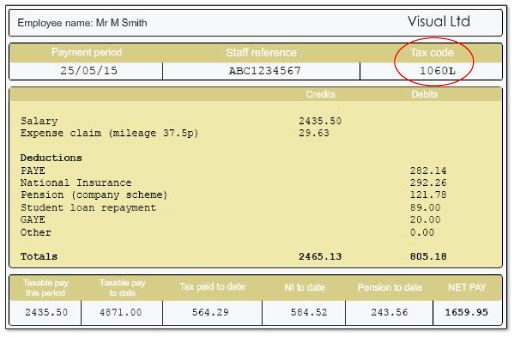

Managing My Money For Young Adults Session 2 5 Openlearn Open University

How To Get The Italian Tax Code Yesmilano

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Fiji Revenue And Customs Service Make Tax Payments To Us Via Online Banking Here S How Payment Type Income Provisional Tax Reference Number Format Tin Tax Code Account Code

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

How To Obtain The Provisional Nie 2022

L Agenzia Italian Health Insurance Card And Foreign Citizens Health Insurance Card For Foreigners Agenzia Delle Entrate

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

/federal-tax-regulations-470991391-d489dd6843964b63bd1cf79c2000fe98.jpg)